How We Work

STEP 1

Download the App

STEP 2

Complete Your Profile

STEP 3

Live Your Best Life

How We Work

Secure Digital Payments for Nepal

A regulated digital wallet and PSP delivering secure, interoperable, and compliant payment solutions supporting Nepal’s cash-lite, inclusive digital economy.

Unified Digital Payment Ecosystem Platform

DigiPay Mobile Money enables seamless P2P and multi-channel transactions, connecting consumers, businesses, institutions, and partners across Nepal’s interoperable digital payment ecosystem.

Digital Disbursements Platform

Supports payments and digital disbursements including bills, education, healthcare, commerce, transport, salaries, government benefits, NGO aid, agriculture, microfinance, and insurance.

Trusted Payment Settlement System

Customer funds are safeguarded in NRB-compliant bank accounts, ensuring secure settlement, interoperability, system stability, and compliant inbound digital remittances.

Governance-Led Secure Payment Platform

Built on strong governance, AML/CFT compliance, cybersecurity, and customer protection, DigiPay enhances efficiency, transparency, and resilience across Nepal’s digital financial ecosystem.

Our Infrastructure

NRB Compliance Certified

Architecture is built on an NRB-Compliant Core System for auditability and adheres to all national security and data sovereignty guidelines.

High Resilience

Achieves near-perfect uptime through Geographic Redundancy (BCP/DRP) and dedicated domestic colocation hosting, surpassing mandatory requirements for service continuity.

Zero-Trust Security

Protects user funds and data using Multi-Factor Authentication (MFA) and End-to-End Encryption (at rest and in-transit), strictly aligning with Cyber Resilience Directives.

Our Infrastructure

DigiPay operates a robust, future-ready financial technology infrastructure that is explicitly designed and certified for regulatory compliance in Nepal.

NRB Compliance Certified

Architecture is built on an NRB-Compliant Core System for auditability and adheres to all national security and data sovereignty guidelines.

High Resilience

Achieves near-perfect uptime through Geographic Redundancy (BCP/DRP) and dedicated domestic colocation hosting, surpassing mandatory requirements for service continuity.

Zero-Trust Security

Protects user funds and data using Multi-Factor Authentication (MFA) and End-to-End Encryption (at rest and in-transit), strictly aligning with Cyber Resilience Directives.

Scalability & Interoperability

Features an API-first core, ready for seamless integration with the National Payment Switch (NPS) and rapid user/transaction growth.

DigiPay Pvt. Ltd. is a regulated Digital Wallet and Payment Service Provider (PSP), operating under the directives and supervisory framework of Nepal Rastra Bank (NRB). The company delivers secure, interoperable, and compliant digital payment and disbursement solutions, supporting Nepal’s transition toward a cash-lite and inclusive digital economy.

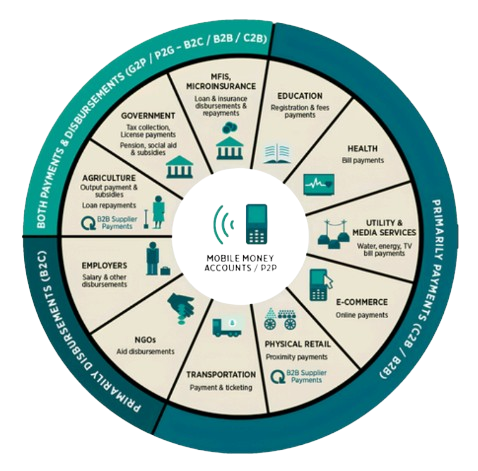

DigiPay’s core offering, the DigiPay Mobile Money Account, enables seamless person-to-person (P2P) transfers and serves as a unified platform for C2B, B2C, B2B, G2P, and P2G

transactions. Through formal partnerships, DigiPay connects consumers, businesses, and

institutions to a broad ecosystem of banks, payment system operators (including NCHL),

telecom operators, merchants, billers, government agencies, microfinance institutions,

employers, NGOs, remittance service providers, and airlines.

The platform supports a wide range of payment services, including utility and media bills,

education and healthcare payments, e-commerce, retail and merchant QR payments,

transportation, and airline ticketing. DigiPay also enables digital disbursements such as

government pensions and subsidies, salary payments, NGO aid distribution, agricultural

payments, and microfinance and micro-insurance transactions.

Customer funds are safeguarded in designated bank settlement accounts in accordance with

NRB regulations, with clearing and settlement conducted through licensed banks and

national payment infrastructure. Integration with PSOs and NCHL ensures interoperability and

system stability, while partnerships with licensed remittance providers enable compliant

digital receipt of inbound remittances

Anchored in strong governance, AML/CFT compliance, cybersecurity, and customer

protection, DigiPay functions as a customer-centric payment interface and a compliance-driven PSP—enhancing efficiency, transparency, and resilience within Nepal’s digital financial

ecosystem